Financial Markets

After extraordinary gains over the past two years, US stocks reversed course and posted losses in the first quarter of 2025. As measured by the S&P 500 Index, stocks fell by 4.3%. Driving the Index lower were stocks of companies whose richly valued shares were predicated on maintaining high rates of earnings growth. Such expectations came into question as views of economic prospects dimmed, and investors rotated to the relatively cheaper shares of companies in more staid and less economically sensitive industries. To wit, the Russell 1000® Value Index gained 2.1% during the first quarter, while the Russell 1000® Growth Index fell by 10%. The 12 percentage point outperformance of the Value Index is the largest since the first quarter of 2001.

The move away from risk was also evident in the bond market as corporate credit spreads widened and yields on US Treasury securities declined. This latter dynamic reflected increased demand for safe assets in light of rising uncertainty. As a result, broad bond indices posted positive returns during the quarter.

International stocks also rose; the MSCI World Ex-US Index posted returns of over 6% during the quarter. There are several reasons for such relative strength, including a falling US dollar, investor rotation away from more expensive US stocks given growth concerns, and favorable shifts in government policy in Europe.

Investment Perspectives

The market’s recent machinations appear, in large part, to reflect changing investor attitudes toward policy initiatives coming out of Washington, DC. More specifically, the honeymoon period in which investors focused on the positive economic aspects of a Trump/GOP agenda (lower taxes, deregulation, etc.) has given way to an attitude of skepticism and concern. Since President Trump assumed office a little over two months ago, the Administration has announced a raft of executive orders and policy priorities on tariffs, government spending, immigration, and geopolitics. Economists and investors are concerned that many new policies will undermine growth, spark inflation, or both. At the same time, the whipsaw nature of announcements has increased uncertainty, spooked investors, and resulted in heightened market volatility.

Tariffs

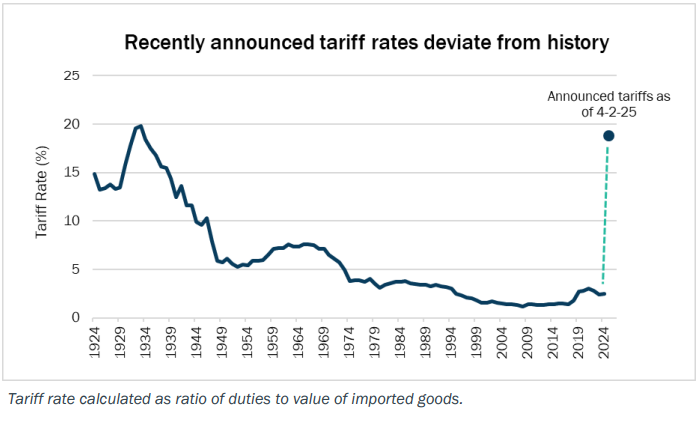

The Administration’s decidedly protectionist stance towards trade policy has been a focus for business leaders and investors alike. President Trump campaigned on levying widespread tariffs on US imports and has followed through while in office, including a major rollout on so-called Liberation Day in early April. Announced tariffs run the gamut, from key raw materials to finished goods, and from our closest allies to our primary competitors for global leadership. Not all announced tariffs are in effect yet; 25% tariffs on imported automobiles and auto parts, among others, are scheduled to go into effect in the coming weeks. Aside from roiling North American supply chains, in which auto components often cross the border several times during the production process, such tariffs could also have broader economic impacts. Higher car prices will almost certainly erode demand, hurting automakers and their employees, but they will also serve to stoke inflationary embers.

Though one impetus for tariffs is to reinvigorate US production, the current dynamics of our economy challenge this goal. For example, tariffs now in effect on steel and aluminum products, for which the US imports 26% and 44% respectively, may result in net losses: there are roughly 8 million construction workers (the leading industry for iron and steel demand) in the US, well outpacing steel industry workers by a ratio of close to 60-to-1. Should higher prices of key commodities crimp construction demand, it would be near impossible for growth in the US steel industry to make up for the economic impact of lost construction jobs.

There are also less tangible, but still significant impacts of the burgeoning trade war. Foremost is uncertainty. The seemingly impromptu nature of tariff introductions, often being followed by alterations and/or retractions, has left business leaders bewildered. Even under the most benign economic circumstances, it is challenging for businesses to accurately forecast future demand and market dynamics to manage or expand their operations appropriately. The erratic nature of the trade war has exacerbated that challenge, even for those industries that might prospectively benefit from a protectionist tilt. The Purchasing Managers Index (PMI), a monthly survey that gauges activity and sentiment in manufacturing sectors, has fallen to levels suggesting industry contraction. Likewise, consumers are not immune to the uncertain path forward. Consumer Confidence, which measures both current and prospective views of the economy, was down materially in March. Notably, consumers’ expectations for the economy over the next 6 months fell to a 12-year low. Another survey of consumers from the University of Michigan pointed to ramping inflation concerns in the near- and medium-term, with the 5 year outlook at its highest level since 1993. Though these surveys are so-called “soft” economic indicators, they can precede hard data when such impressions translate to lighter spending or impact other financial decisions that influence the trajectory of the economy.

Fiscal and Other Policy Changes

Government spending comprises almost a quarter of US GDP, while tax policy can heavily influence consumer and corporate behavior. Accordingly, fiscal policy is another integral component of the economic outlook. In March, Congress agreed to a Continuing Resolution to fund the government through the end of the September fiscal year. Though this took the prospect of a near-term government shutdown off the table, much still hangs in the balance. A razor-thin GOP majority challenges party leaders in their construction of tax legislation that can pass both houses of Congress before the President can sign it into law. Specifically, rhetoric from some Republican members of Congress suggests they will not agree to prospective tax cuts without significant spending reductions. And while the Department of Government Efficiency (DOGE) has been very much in the news (and a source of distress and uncertainty for many federal employees and contractors), it has yet to find material budgetary savings. Discussions are undoubtedly happening all over Capitol Hill, and we expect to hear more regarding the contours of a GOP tax bill in the coming weeks.

Other policy initiatives can also meaningfully influence economic prospects, though their impacts may be less direct. An effort towards deregulation, in terms of both removing industry-specific restraints as well as a lighter touch on anti-trust and broader oversight concerns, was seen as a key contributor to the post-election rally. However, action on that front has been limited to executive actions that have been more geared towards style than substance and political appointments that have yet to make significant impacts. Immigration policy can also have economic consequences. The Administration’s implementation and broadcasting of a sweeping immigration crackdown has continued the months-long decrease of migrants illegally crossing the US southern border; crossings are now at their lowest levels in decades. It’s unclear whether today’s low levels are sustainable, but the prospect of fewer lower-wage migrant workers could impact labor markets, wage growth, and, in turn, inflation.

The Fed’s Predicament

Like economists and investors, policymakers at the Federal Reserve are concerned and have reduced their economic growth expectations. The Fed governors’ median forecast for 2025 real GDP growth is now 1.7%, down from 2.1% in December. Going further, the policymakers are almost unanimous in their views that risks are weighted to the downside — a significant deterioration from the previous “balanced” consensus. Meanwhile, core inflation expectations from the group have risen. The combination of slowing growth and rising inflation puts the Fed in a bind — should it protect economic growth (and full employment) or keep inflation in check? The Fed’s stance, via Chairman Powell’s comments after its March meeting, indicates a comparable view between the two forces, but moreover, a mantra of patience. Like us and other investors, the Fed is waiting for clarity on the aforementioned policy fronts and resulting data impacts and, thus, is not in a hurry to make sweeping adjustments of its own.

Outlook and Positioning

The lack of clarity on trade, fiscal, monetary, and other policy has opened a wide range of potential outcomes for the economy, including an increasing proportion on the downside. Such uncertainty can be especially challenging for investors. Accordingly, we remain committed to identifying companies with strong financial underpinnings and durable business models that can weather a range of economic environments. Importantly, and as ever, we seek to avoid the shares of companies whose valuation implies unreasonable expectations of future growth. As we observed in the first quarter, burgeoning economic uncertainty has prompted investors to become more discerning with respect to future growth expectations, and we expect such a trend to continue.

We continue to believe that holding high quality bonds in multi-asset portfolios provides an important source of portfolio ballast, as well as healthy income yield, as the dizzying pace of economic news and policy announcements is likely to perpetuate heightened levels of market volatility.