Boston Trust Walden has been integrating environmental, social, and governance (ESG) risks and opportunities into investment decisions since 1975 – one of the longest track records of any institutional investment manager. ESG considerations are integral to our investment philosophy. Simply stated, we seek to invest client assets in enterprises with strong financial underpinnings, durable business models, prudent management practices, and a governance structure that supports these objectives.

Thus, a core component of our equity research process is recognizing the financial materiality (or significance) of ESG-related risks and opportunities involved in a potential investment. For companies considered for inclusion in client portfolios, a securities research analyst and ESG analyst review the company simultaneously and collaboratively. We illustrate this process below using a case study of the company McCormick & Company (McCormick).

Company Overview

McCormick is a global leader in flavor. The company manufactures, markets, and distributes herbs, spices, seasonings, condiments, and flavors that enhance taste and nutrition to the entire food and beverage industry including retailers, food manufacturers, and foodservice businesses. McCormick flavors can be found in its eponymous line of spices, but also in well known brands including French’s, Old Bay, Frank’s Red Hot sauce, and Stubb’s. McCormick is uniquely positioned to meet the growing demand for great tasting foods and beverages through authentic flavor innovation, sustainable sourcing practices, and health and wellness enhancement. The total market for its products continues to grow and was recently estimated to be approximately $19 billion globally.1

Our Analysis

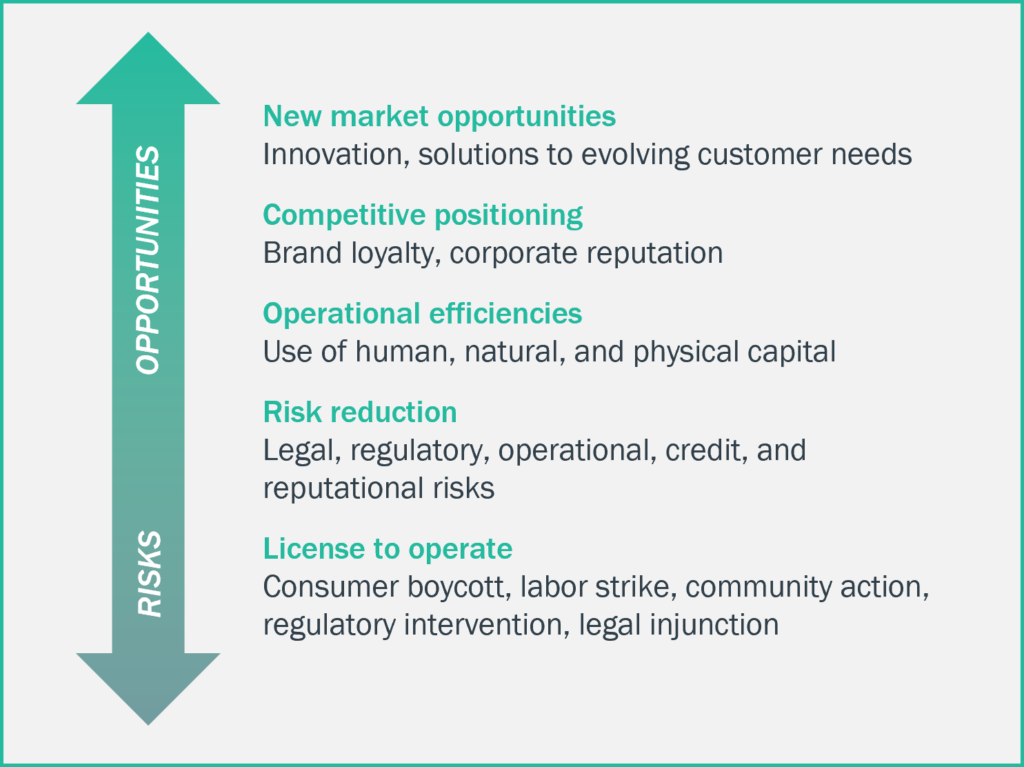

For potential investments, a Boston Trust Walden securities research analyst and ESG analyst work together to evaluate a company’s performance with two objectives in mind related to its ESG profile: 1) to identify potential ESG risks and opportunities for further investigation, recognizing ESG factors can be positive, neutral, or negative; and 2) to enhance our understanding of potential financial outcomes associated with issues ranging from risks (e.g., physical risks to operations) to opportunities (e.g., generating new sources of revenue). Issues range from broad sector considerations to company-specific performance and are informed by potentially material ESG issues, as identified by the Sustainability Accounting Standards Board (SASB), in addition to our own knowledge and experience.

The retail herbs and spice category is structurally attractive for several reasons. First, there is typically one strong market leader in each developed market with a significant market share advantage over the next largest brand. This is because the category has fairly limited shelf space in grocery stores (product turnover is fairly low compared to other food categories), allowing the market leader to command premium pricing. Second, the profit per unit of retailer shelf space is usually high due to the premium prices, smaller package size, and stronger profit margins of each item compared to other grocery products. Finally, the category is well aligned with consumer trends. The combination of premium pricing power, efficient use of limited shelf space, and alignment with long-term consumer trends creates a highly defensible competitive position for a market leader like McCormick. These structural advantages enable McCormick to generate superior returns per unit of shelf space while participating in favorable secular growth trends that show few signs of abating.

Understanding the ESG Risks and Opportunities

Potential ESG risks and opportunities for global food manufacturers commonly include sustainable sourcing, supply chain resilience, product quality and safety, consumer health trends, environmental impact, and labor practices. In the case of McCormick, our research revealed the business model focuses on products that emphasize flavor innovation, sustainable sourcing, and health benefits of herbs and spices. These elements of McCormick’s strategy presented potential new market opportunities as consumers increasingly prioritize natural and healthy food options. Moreover, we noted the company’s efficient use of resources in the manufacturing process through sustainability initiatives as a cost-saving opportunity, which has translated to gradual margin expansion over the long term.

For McCormick, a strategic focus has been to build out the company’s “Grown for Good” sustainable sourcing framework designed to address specific supply chain risks by enabling farmers to become more resilient to unforeseen challenges. The framework has allowed McCormick to strengthen relationships with strategic suppliers by investing in programs such as climate-smart agriculture training that provides opportunities for farmers to proactively manage climate-related risks. Due to the nature of its business, McCormick sources approximately 14,000 ingredients; within this there are 3,000 agricultural products from over 85 different countries and, in many cases, multiple regions within those countries. Each community faces their own unique challenges and therefore there is no “one size fits all” solution to building resiliency. Since its launch in 2019, the “Grown for Good” framework has expanded to 16 commodities cultivated across more than 54,000 acres of farmland in 11 countries.

In 2024 McCormick achieved 95% sustainably sourced branded black pepper, cinnamon, oregano, red pepper, and vanilla, ensuring supply chain resilience and quality standards for its top five ingredients. The “Grown for Good” standard will extend to the rest of its herbs and spices portfolio and other ingredients over time. These programs reflect McCormick’s commitment to sustainable agriculture practices when compared with traditional sourcing methods and also differentiate the company from its competitors.

McCormick also sells a wide range of health and wellness-focused products for consumer and foodservice customers. Approximately 65% of McCormick’s revenue in the Americas and EMEA comes from products that encourage healthier, more nutritious, and natural consumer choices, backed by research from the McCormick Science Institute that demonstrate the health benefits of herbs and spices. The shift to both sustainable sourcing and health-focused products also unlocked new market opportunities. The value these products provide build trust among customers who, in turn, demonstrate a higher willingness to pay a premium for them. Our analysis revealed that McCormick’s comprehensive sustainability approach supports long-term business resilience and positions the company to capitalize on evolving consumer preferences toward natural and sustainable food choices.

Further, our analysis highlighted that resource usage, greenhouse gas emissions (GHG), and efficiency in the manufacturing process had markedly improved over time. McCormick established science-based targets validated by the Science Based Targets initiative (SBTi) to reduce absolute GHG emissions by 42% by 2030 against a 2020 baseline. The company delivered a 37% reduction in Scope 1 and 2 emissions and a 2% reduction in Scope 3 emissions in 2024. Similarly, McCormick established a target of 25% reduction in water usage by 2030 and achieved a 6% improvement in 2024, along with a 75% recycling and recovery rate of solid waste from their facilities.2 These initiatives contributed to operational efficiency improvements, enhancing the financial quality of the business.

Our Investment Decision

Boston Trust Walden makes active investment decisions based on our assessment of financial quality, the sustainability of the business model, and valuation of the stock. Our analysis of ESG risks and opportunities informed our view of McCormick’s operational strengths and weaknesses. Our research revealed strong underlying fundamentals, in part driven by a global supply chain that reduces production waste and efficiently sources ingredients from over 85 countries, coupled with a portfolio of products that benefits from numerous ESG tailwinds.

With this ESG opportunity and risk mitigation information, we determined the company’s improving margin profile and favorable ESG profile enhanced the sustainability of McCormick’s business model. That view informed our conclusion that the valuation was attractive. Ultimately, our Securities Research Committee concurred with the analysts’ recommendation to retain McCormick on the Boston Trust Walden approved list, making the stock eligible for client portfolios.

In Summary

ESG risks and opportunities can affect corporate performance and ESG analysis played a crucial role in our assessment of McCormick. We believe it is prudent to recognize the financial materiality of ESG issues, and Boston Trust Walden is committed to doing so as we seek to invest client assets in a set of securities well situated to minimize risk and produce durable returns.

1 https://mccormick.widen.net/s/t9kvtbsssn/plp_2024_report_final