Q2 2023 ESG Impact Report – 2023 Proxy Season

by Boston Trust Walden

July 12, 2023

The 2023 proxy season featured many familiar and consistent trends from years past, but also some new and emerging themes reflecting the changing economic, social, and environmental context for business.

The number of shareholder proposals appearing on the ballots of company annual meetings continues to eclipse historical levels as more shareholders become active in the proposal filing process, with climate risk representing the most frequent topic. The average support for shareholders proposals overall fell below 20% in 2023, a precipitous drop from a high of over 31% in 2021. The season saw just nine proposals receiving majority support from shareholders compared to 34 just two years prior.

A series of factors may be contributing to this shift in support. One example is the rising number of proposals filed by a small number of “anti-ESG” proponents — those seeking to compel company action antithetical to the objectives of traditional ESG-related resolutions. These actors filed 84 such proposals in 2023 after putting forward only 33 in 2021. These proposals tend to fare poorly, often receiving less than 5% support, bringing down the average level of support for all shareholder proposals.1

Amidst the noise, Boston Trust Walden’s voting record has remained consistent, demonstrating the principled approach we bring to stewarding the assets of our clients.

During the 2023 season, we supported nearly 65% of the 203 shareholder proposals observed at portfolio companies, reflecting our process to carefully consider individual proposals and evaluate the merit of each request to address significant ESG risks and opportunities and foster creation of long-term shareholder value.

Season Trends

Focus on Human and Labor Rights

Persistent allegations of human rights violations in global value chains and notable incidents of labor strife in the US railroad and service industries compelled investors this year to ask companies to examine how their operations, products, and supply chains may contribute to violations of basic human and labor rights. During the 2023 proxy season, 17 proposals called on companies to adopt or report on the efficacy of human rights policies. An additional eight filings asked companies to align policies related to freedom of association and collective bargaining with the International Labor Organization’s Fundamental Principles, generally earning over 30% support and outpacing the overall average backing of shareholder proposals for the season.2

Impact of Diversity, Equity, and Inclusion (DEI) Efforts

Consistent, comparable, and comprehensive workforce composition data enables investors to more accurately assess and value company actions to ensure equitable representation at all levels. Additional details and context regarding DEI policies, practices, and performance over time helps determine the effectiveness of companies’ human capital management programs. To this end, several proposals this proxy season asked companies to provide supporting metrics such as hiring, promotion, and retention rates to better demonstrate the effectiveness of DEI efforts. One proposal filed with a global logistics company received the support of more than 57% of shareholders.3

Continued Rise of Anti-ESG Proposals

As noted previously, we continue to observe a dramatic increase in “anti-ESG” shareholder proposals — more than 2.5 times the number filed just two years ago. These proposals add complexity to the proxy voting process, often using language that mirrors those of ESG-related investor requests yet coupled with accompanying rationales advocating for the exact opposite. In the 2023 proxy season, a growing number of anti-ESG proposals explicitly questioned the value of corporate commitments towards ESG, including those to increase the diversity, equity, and inclusivity of workplaces or to pursue net-zero carbon emissions by 2050. Shareholders, however, are consistently voting against these proposals — with the vast majority receiving less than 5% of shareholder support.4

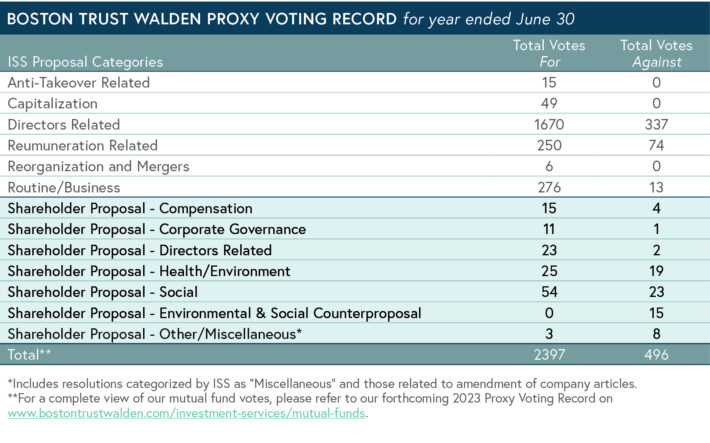

How Boston Trust Walden Voted

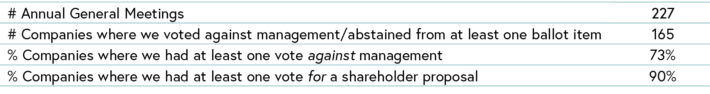

During the 2023 proxy season, Boston Trust Walden supported at least one shareholder proposal at 90% of the 69 annual meetings of portfolio companies at which such proposals were filed. Often multiple resolutions are filed at a single annual meeting; therefore, careful consideration is required to evaluate the specific financial and ESG risk and opportunity implications of each individual proposal. As a result of Boston Trust Walden’s diligent approach to proxy voting, we supported nearly 65% of the 203 unique shareholder proposals filed with portfolio companies.

But shareholder proposals are just one of the ways to influence change at a company through proxy voting; we also do so via our evaluation of management recommendations. In 2023, Boston Trust Walden voted against management recommendations on at least one ballot item at 73% of company meetings – up from 51% in 2021 – driven primarily by increases in votes against boards lacking sufficient diversity and votes against executive compensation plans.

In cases where Boston Trust Walden voted against management’s recommendations related to our priority areas (climate, equality, and governance), we communicated the rationale for our vote and set the stage for future engagement. Reaching more than 100 companies in 2023, we consider this post-proxy outreach to be a critical element of the cyclical and reinforcing design of Boston Trust Walden’s active ownership strategy.

Directors

Board diversity is a critical attribute of a well-functioning board and a measure of sound corporate governance. In 2023, we voted against at least one director at 45% of companies, an increase from 42% last year. Our reasoning to vote against directors included inadequate board diversity, overboarding of directors, or demonstrable failures in ESG risk management.

Executive Compensation

Annual meetings routinely give us the opportunity to affirm company compensation programs for executives (“Say on Pay”) and provide a mechanism and impetus for constructive engagement between shareholders and directors on pay issues. Boston Trust Walden believes executive pay programs should be fair, competitive, and create appropriate incentives to promote long-term shareholder value. Our approach led to votes against executive compensation programs at 28% of companies, a slight increase from 26% in 2021 and 18% in 2020.

Boston Trust Walden Shareholder Resolutions

Shareholder resolutions are a critical lever of our active ownership strategy — an escalation tactic we employ when attempts at sustained engagement via dialogue are unproductive. At Boston Trust Walden, the recent introduction of broad multi-year engagement initiatives spanning our entire portfolio have delivered some immediate results, providing optimism that additional impact can be delivered through persistent dialogue.

For example, through Boston Trust Walden’s multi-year initiative to urge portfolio holdings to annually disclose workforce composition, we have observed companies increasingly recognizing the value of demonstrating the benefits of diversity, equity, and inclusion efforts. To date, we have engaged nearly 100% of our holdings on this issue and continue to do so as new securities are added. At the end of 2022, approximately 54% of companies across investment strategies had released EEO-1 reports, compared with just 20% a year prior.

Similarly, in pursuit of our target through the Net Zero Asset Managers (NZAM) initiative for 40% of discretionary equity assets under management to be invested in companies with science-based targets by 2025, this year we initiated engagement with companies across all portfolio strategies. In 2022, Boston Trust Walden engaged nearly 140 companies on the topic of climate risk — including 70 small and SMID cap equity holdings. Though we filed fewer resolutions this year, our engagement laid the groundwork to influence these companies as they strive to develop the systems and practices needed to decarbonize their businesses.

While a resolution is a valuable tool when dialogue becomes unproductive, the ultimate goal of engagement is measurable improvement in ESG policies, practices, or performance. Our most successful shareholder resolutions may never make it to the printed proxy statement, but instead are withdrawn upon the achievement of meaningful agreements with the engaged companies. And with successful and constructive engagement, we may never have to file a resolution at all.

During the 2023 proxy season, Boston Trust Walden led four shareholder resolutions, two of which were withdrawn based on negotiated corporate commitments. Boston Trust Walden withdrew a board diversity proposal at Medpace Holdings after the company nominated its first diverse director to serve on the Board. And the withdrawal of our resolution with UPS, calling for greater transparency of the company’s lobbying and political expenditure policies and performance, offers a valuable case study of how success can be delivered through persistent engagement (read full story here).

Of the resolutions that went to vote, our proposal at Texas Roadhouse seeking greater evidence of climate risk management efforts received support from over 40% of shareholders (read full story here). A resolution with Alphabet seeking an evaluation of direct and indirect lobbying alignment with the Paris Climate Agreement received 14.1% support; however, given Alphabet has stock with unequal voting rights, voting support is likely understated.

1 Welsh, Heidi. Sustainable Investments Institute Engagement Monitor Search. June 26, 2023. Sustainable Investments Institute. https://siinstitute.org/

2 Ibid.

3 Expeditors International of Washington, Inc., Form 8-K (filed May 2, 2023), https://www.sec.gov, accessed July 2023.

4 Welsh, Heidi. Sustainable Investments Institute Engagement Monitor Search. June 26, 2023. Sustainable Investments Institute. https://siinstitute.org/

About Boston Trust Walden Company

We are an independent, employee-owned firm providing investment management services to institutional investors and private wealth clients.