Q4 2023 Investment Commentary

by Boston Trust Walden

January 11, 2024

Financial Markets

Stocks closed a strikingly strong year on an even stronger note, with most primary equity indices registering double-digit gains for both the quarter and year. The S&P 500 Index led the charge with a 26.3% calendar year return. The Index’s impressive gains were driven by the so-called Magnificent Seven — a group of technology-related behemoths that include Alphabet (Google), Amazon, Apple, Meta (Facebook), Microsoft, Nvidia, and Tesla, and account for over a quarter of the capitalization-weighted S&P. Though their 2023 gains were extraordinary, these stocks fell sharply in 2022, so their two-year returns are less remarkable; in fact, three of the stocks declined over the two-year period. The same pattern holds for the S&P itself, which closed 2023 at roughly the same price level it began 2022. And while those seven stocks were responsible for over 60% of the Index’s 2023 gains, most of their dominance came in the first part of the year; the S&P’s 11.7% rally in the final quarter was far more widespread. In fact, the average stock, as measured by the S&P 500 equal-weighted Index, gained 11.9% during the last three months — bringing the average gain for the year up to 13.8%.

Bonds also had an eventful year and final quarter, driven by the Federal Reserve’s monetary policy maneuvers and the evolving perspectives of investors regarding future interest rates. But despite the volatility, the moves in longer-term interest rates largely amounted to a round trip. The yield on the 10-year Treasury note began the year at 3.88% and rose to a peak of 4.98% in October as the Fed continued its fight against inflation. However, when inflation data appeared to soften, and the Fed indicated it was nearing the end of its rate increases, investors began to push longer rates back down. The yield on the 10-year Treasury closed the year exactly where it began: 3.88%. Accordingly, and though rate movements varied across the maturity curve, investors in such government issues were largely left with their coupon payments as the year’s return, with little change in the underlying price of their bonds. Broad bond index returns, like that of the Bloomberg US Aggregate Index, were augmented by credit spread tightening, with the primary investment grade indices providing returns in the mid-single digits for the year.

Investment Perspectives

Reflecting on the ups and downs of economic data and asset prices over the past year, it becomes apparent that we find ourselves not just at the end of another notable year, but also at the culmination of the COVID-induced business cycle. The economic reverberations of the pandemic were both wide-ranging and severe but have been diminishing in breadth and amplitude for some time. Thus, we enter 2024 with a greater sense of normalcy than at any time since the beginning of 2020, though it brings as much uncertainty as ever.

Finding Equilibrium

Many elements of the economy were dramatically affected by the onset of the pandemic and have been on the path to normalization over the last couple of years. A case in point is global supply chains. Roiled by lockdowns and border closings, then further exacerbated by heightened demand for physical goods while people were receiving stimulus checks but stuck in their homes, complex global supply chains struggled mightily in the earlier stages of the pandemic. Limited supplies and output translated to higher prices and the initial indication of the inflationary forces that were to come. However, according to the Federal Reserve’s analysis, global supply chain pressure had begun abating in earnest by the beginning of 2022 and had reached “normal” levels in early 2023. In addition to businesses adjusting supply chains, government intervention, and the passage of time, such improvement was aided by receding demand for physical goods in favor of services.

Another bottleneck soon appeared as lockdowns loosened: a shortage of workers. With many would-be employees having left the labor force due to health concerns, abundant savings (including pandemic-related government transfer payments), or other reasons, many businesses found themselves struggling to hire sufficiently to meet resurgent demand. As higher wages are typically the best and most straightforward way of attracting workers, average hourly pay began increasing at its fastest pace in decades. Wage hikes — and businesses increasing prices to retain their profit margins in the face of such higher costs — were another key component of inflationary pressure. However, in the second half of 2023, the labor market began to find more balance as consumers either sated their pent-up demand for travel and entertainment and/or exhausted their excess savings as more workers re-entered the labor force. By the time 2023 ended, wage gains had begun to moderate.

As noted, both consumer demand and the market for labor were influenced by extraordinary cash balances US households accumulated due to government stimulus and a reduction in spending during lockdowns. Those excess reserves, which were also likely key to maintaining consumer confidence through various worrying geopolitical and economic events (e.g., Russia’s invasion of Ukraine, US debt ceiling crisis, and regional bank turmoil), have now largely been spent. Moreover, US households’ debt balances have reached all-time highs and are prone to the ravages of now-higher interest rates. Though the economy appears to be on solid footing and the normalization of many aspects — particularly those directly related to inflation and interest rates — are decidedly positive, the weaker balance sheets of consumers suggest there is less cushion for the economy should it suffer another shock.

Moderating Inflation and Policy

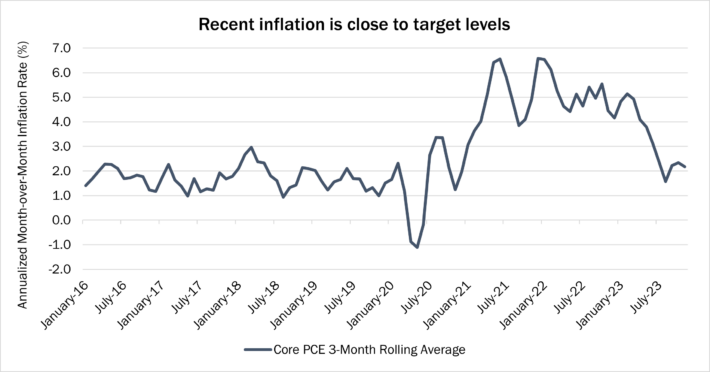

Aggregate inflation has fallen significantly. The year-over-year increase in the headline Consumer Price Index (CPI) was 3.1% in November — down almost two-thirds from its peak level of 8.9% in mid-2022. The Federal Reserve’s favored metric, the Personal Consumption Expenditures Index, is at similar levels — even after excluding the benefit of volatile food and energy prices that are now receding from recent spikes. Though these year-over-year readings are not quite at the Fed’s 2% target, recent month-over-month inflation figures suggest we are getting closer to such benign levels. The chart below shows a more contemporaneous view of aggregate inflation. To be sure, pockets of pricing pressure remain, but the disconcerting levels from a year ago have all but faded.

Though short of claiming “mission accomplished,” the Fed has messaged that after almost two years of increases, its interest rate hiking cycle is likely over. In fact, a report released by the Fed after its meeting in December indicated it anticipates cutting interest rates several times in the coming year. This was quickly interpreted by investors as a bullish sign for stocks and bonds, and financial markets rallied. Chairman Powell was compelled to quickly pivot and toss some cold water on markets by reiterating that the Committee remains data-driven. We expect the fluidity of such expectations to continue to manifest in the volatility of financial asset values — most notably stocks and bonds. Regardless of how many rate cuts may come in 2024, that the Fed is likely no longer increasing borrowing costs is significant.

Election Uncertainty

2024 brings another US election to determine the President as well as control of both houses of Congress. Though we don’t anticipate significant fiscal policy changes from Washington in the lead-up to November, prospective policy stances of the candidates may provide for market volatility with investors reacting to polling and anticipated changes. There is also the prospect of a government shutdown as recent funding packages begin to expire in the coming months. And such political uncertainty is not limited to the US. There are numerous important elections taking place across the globe in the coming year, including in India, Mexico, Indonesia, Taiwan, and much of Europe. All told, participants in 2024 elections account for 60% of global economic output. As significant trading partners, producers of energy or other critical minerals or components, or due to their geopolitical significance, these countries and their leadership can influence global and domestic economic prospects alike.

Outlook and Positioning

We begin 2024 with improved business conditions from a year ago: inflation is down, a historic interest rate hiking cycle is behind us, and the labor market and consumer spending remain healthy. And though we have yet to see the full impacts of the Fed’s previous rate increases, its more accommodating stance bolsters our expectations that we will avoid a near-term recession. Wall Street consensus also points toward a proverbial “soft landing,” and corporate earnings growth is expected to accelerate in 2024. Though the market’s price/earnings ratio is above historical averages, this is due to stretched valuations in many of the Magnificent Seven and other technology stocks. In contrast, the valuations of many non-technology stocks do not reflect such a favorable outlook and thus appear more reasonable. This discrepancy — and the opportunity to find reasonably valued shares of high quality businesses — is core to why we continue to favor stocks in multi-asset portfolios. To be sure, it is difficult to envision the S&P 500 Index duplicating its impressive return of 2023. However, more widespread gains (i.e., continued breadth outside the Magnificent Seven) are entirely plausible and favor disciplined active management in a more normal but still uncertain environment. As ever, we continue to focus on identifying high quality companies whose businesses can thrive in a range of economic conditions and whose shares do not imply overly optimistic outcomes.

But even normalcy brings uncertainty, and risks remain. Among the usual economic and geopolitical concerns, these now include less flush US consumers, whose spending is likely more susceptible to disruption when unforeseen events inevitably occur. Accordingly, any such event is likely to bring volatility to financial markets. To help protect portfolios against this, we continue to own a significant allocation of fixed income instruments in multi-asset accounts. Bonds offer protection should economic conditions deteriorate or an extraneous event undermine confidence. In addition, interest rates are significantly higher than they have been for much of the past decade, and the prospect of lower interest rates from the Fed bodes well for forthcoming bond returns.

Boston Trust Walden Company is a Massachusetts-chartered bank and trust company.

Past performance is not indicative of future results.

Sources: Factset, Bloomberg, Standard & Poor’s, US Treasury, US Bureau of Economic Analysis, Federal Reserve Bank of New York

The information presented should not be considered as an offer, investment advice, or a recommendation to buy or sell any particular security. The information presented has been prepared from sources and data we believe to be reliable, but we make no guarantee to its adequacy, accuracy, timeliness, or completeness. Opinions expressed herein are subject to change without notice or obligation to update.

About Boston Trust Walden Company

We are an independent, employee-owned firm providing investment management services to institutional investors and private wealth clients.