Q1 2022 Investment Commentary

by Boston Trust Walden

April 14, 2022

Financial Markets

After a three-year period in which the S&P 500 doubled, the market gave back some of those gains in the first quarter of 2022. The S&P 500 Index fell by only 4.6% during the period, but it did so in unsettling fashion, with volatility reaching levels not seen since the throes of the pandemic. Richly valued “growth” stocks led the market lower, underperforming “value” stocks. This was in part due to rising long-term interest rates, which hurts growing companies more than mature ones. At the same time, rising commodity prices helped shares of energy and mining companies, which are disproportionately considered value stocks. Most segments of the domestic market, as well as broad international indices, also had negative returns for the quarter.

Broad domestic bond indices performed worse than the S&P 500. The Bloomberg Government/Credit Bond Index lost 6.3% as rising interest rates and widening credits spreads pushed bond prices lower. Crude oil prices, already having increased by 50% in 2021 due to rising demand, moved even higher as Russia’s invasion of Ukraine disrupted supply. Brent crude, the primary global oil benchmark, started the quarter at $78/barrel and peaked at $128 shortly after the invasion before settling back to $105 by the end of March.

Investment Perspectives

Throughout the first quarter, investors were continually reacting to forces that will shape the economy and affect asset prices. The Omicron wave seemed to signal a step back in the pandemic, yet the economic recovery, marked by an exceptionally strong labor market and resilient consumption, largely powered through. Observing such strength, the Federal Reserve, among other central banks around the world, voiced renewed determination to tamp down the resulting inflationary pressure. Such policy change can be unnerving for investors given the wide-ranging impacts the Fed has on the economy and financial markets. Further clouding the outlook, Russia’s regional antagonism, followed by its invasion of Ukraine, affected commodity markets and increased both uncertainty and market volatility. Despite all this, prospects for economic growth and corporate profits remain positive, this year and beyond.

Resilient Expansion

The US economy remains on solid footing. The labor picture has been the star of the show. With an already low unemployment rate, the labor market’s momentum carried through the Omicron wave, and workers continue to benefit from robust wage gains. Household balance sheets also remain healthy. Rising home and stock values have allowed assets to outpace liability growth, while stimulus payments, other government-funded relief, and ultra-low interest rates provided an opportunity to relieve the burden of outstanding debt. Driven by the strength of the labor market and consumers, economists expect real GDP to expand by 3.5% in 2022.

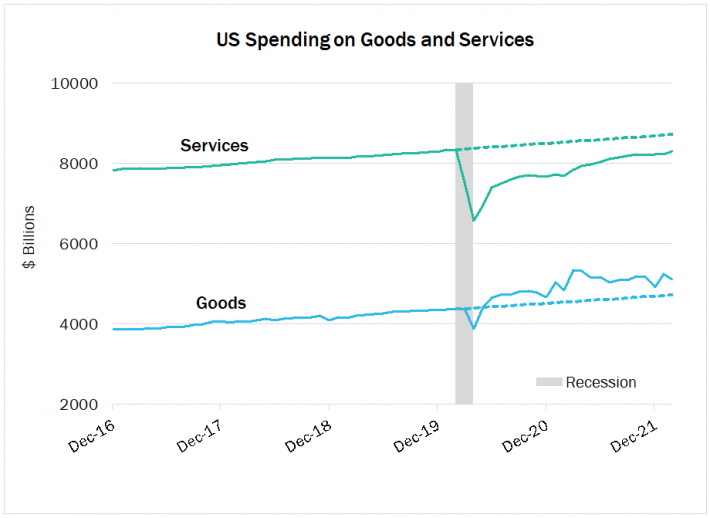

While the strength of the consumer has propelled economic growth, it has also spurred inflationary forces. Spending patterns shifted during the pandemic toward physical goods, and away from services, due to activity restrictions. In fact, spending on goods rebounded quickly after the initial shock of the pandemic and surpassed pre-pandemic levels by late spring 2020. Demand for services, however, took much longer to recover and is only now approaching pre-pandemic levels.

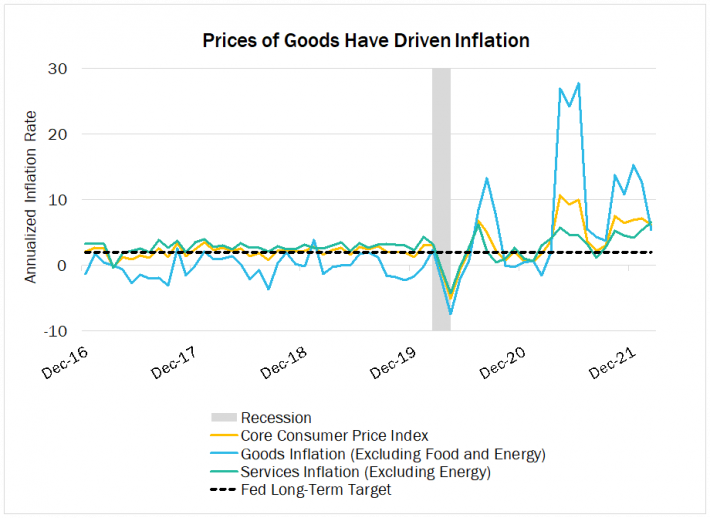

The shift in consumption translated to a disparity in pricing pressures. With outsized demand for physical goods converging with pandemic-disrupted supply chains, prices moved higher. Though US consumers spend almost twice as much on services than on goods, the price increases of the latter have been the primary culprit behind the extraordinary headline inflation readings we have seen for several months. However, inflation has potential to build on the services side as recovering demand intersects with already tight employment conditions.

The Fed Begins to Tighten

The combination of higher inflation and a strong labor market has compelled the Fed to act quicker than originally anticipated. In a speech in late March, Fed Chairman Jerome Powell drove home the need to address inflation before it becomes further entrenched. But he also emphasized the goal to do so while not sending the economy into recession. Though such a “soft landing” has been the objective of previous Fed tightening cycles, it is not always achieved. We do not expect a recession in the near-term, but the renewed commitment to bringing inflation under control has undoubtedly raised the probability of such an outcome from where it was prior.

Changes in Treasury bond yields exhibited the changing policy dynamics. To date, the Fed has only increased its overnight interest rate once — by 0.25% in mid-March. However, investors’ collective expectations for where the Fed’s policy rate will go can be readily observed via yields on Treasury bonds with longer maturities. For example, the 2-year Treasury yield broadly indicates the market’s expectation for the Fed’s policy rate two years hence. At the end of last March, the yield on the 2-year Treasury bond was 0.16%, reflecting negligible expectations for a forthcoming rate hike. The yield has since risen substantially — to 0.73% by year-end before jumping to 2.28% in the last quarter — as investors acknowledged the Fed’s commitment to tightening in the face of surging economic growth and inflation. The move in the 10-year Treasury was less dramatic, and its quarter-end yield almost equaled that of the 2-year bond. This muted increase and lack of difference between short and long-term Treasury yields likely reflects investors’ concern over less favorable longer-term economic outcomes — due to the Fed’s actions or other possible disruptions.

Russian Invasion

Beyond initiating a heartbreaking humanitarian crisis, Russia’s invasion of Ukraine has implications for the global economy. To be sure, Russia’s share of global GDP is quite small; it accounted for less than 2% of the world’s economic output in 2020. Its share of aggregate corporate revenue exposure for the companies in our strategies is even less. However, Russia and Ukraine are significant commodity producers and exporters, particularly of oil, natural gas, grains, and metals. Accordingly, both physical and sanction-initiated supply disruptions caused global commodity prices to move sharply higher in the first quarter. This comes on top of the demand driven commodity price increases observed through the past two years of economic recovery.

Markedly higher energy prices have clouded the domestic economic outlook. They act as a tax on consumers who need to spend more for gasoline, heating fuel, and other commodities. For corporations, higher input and production costs (even if overseas) provide another impetus to raise prices. The combination complicates the already narrow path the Federal Reserve was trying to chart between fighting inflation while maintaining growth.

We continue to hope for a peaceful resolution to the conflict. Even when tensions do calm, commodity prices may stay elevated as it is unlikely that Russian exports will flow to the West at their previous levels. For energy in particular, the development of sufficient replacement sources, whether conventional or alternative, will take time to establish.

Outlook and Positioning

In the near-term, we expect the economy to continue to grow, while interest rates rise further as the Fed’s tightening cycle begins in earnest. Inflationary pressures are unlikely to fully abate this year, though we expect they will in time. Chairman Powell cited a three-year period for inflation to return to the Fed’s target 2% range, and we agree that certain transitory factors, such as supply chain issues and energy supply disruptions, are likely to eventually give way to longstanding deflationary forces of technology, globalization, and demographics. A policy-driven recession, in which the Fed overshoots its target and sends the economy into recession, does not appear likely in the next 12-18 months. We also continue to monitor other potential disruptions to economic growth. Though the risk of Russia’s invasion has been realized, other geopolitical risks remain. In particular, China’s integral role in the global economy heightens risks associated with the country’s policies, including COVID shutdowns and its political endeavors.

In aggregate, corporations should participate in the economic expansion via continued revenue growth. However, the protection of profit margins in the face of rising input costs may only be afforded to those companies that are able to raise their prices without undermining their business. Additionally, given the prospect of higher interest rates and borrowing costs, companies with high levels of debt may get squeezed. Investing in durable, high quality companies has always been our focus at Boston Trust Walden, but such a strategy is particularly well suited for current circumstances. As is avoiding shares of companies whose valuation implies unreasonably optimistic assumptions. We continue to maintain such discipline, and in the context of client-specific circumstances, favor stocks over cash and fixed income investments. We do, however, expect the recent spate of heightened equity market volatility to persist as the many crosscurrents we note above evolve.

Boston Trust Walden Company is a Massachusetts-chartered bank and trust company.

Past performance is not indicative of future results.

Data Sources: Bloomberg, FactSet, World Bank

Chart Sources: “US Spending on Goods and Services”: US Bureau of Economic Analysis (Personal Consumption Expenditures, seasonally adjusted and annualized). “Prices of Goods Have Driven Inflation”: US Bureau of Labor Statistics (Consumer Price Index, seasonally adjusted and annualized monthly change).

The information presented should not be considered as an offer, investment advice, or a recommendation to buy or sell any particular security. The information presented has been prepared from sources and data we believe to be reliable, but we make no guarantee to its adequacy, accuracy, timeliness or completeness. Opinions expressed herein are subject to change without notice or obligation to update.

About Boston Trust Walden Company

We are an independent, employee-owned firm providing investment management services to institutional investors and private wealth clients.