Q2 2019 Commentary

by Boston Trust Walden

June 30, 2019

Financial Markets

Virtually all major stock indices, domestic and international, recorded positive returns in the second quarter. The indices also largely followed the same month-to-month pattern, as the global first quarter rally continued into April, pulled back in May, only to advance higher in June. The S&P 500 Index set a new high in late June and recorded a total return of 4.3% for the full quarter.

Helping to propel the market were first quarter corporate earnings’ reports that generally exceeded low expectations. Aggregate S&P 500 earnings were 0.4% below those from the year prior (which included the outsized benefit associated with the 2017 tax cut), but better than the 4%+ quarterly profit reduction Wall Street had feared. Nonetheless, this was the first quarterly earnings decline for the S&P 500 since 2016. Financial and information technology stocks led the market, though all sectors but energy rose. After fluctuating significantly during the period, crude oil prices ended the quarter just shy of the $60/barrel where they began.

Bond prices also rose during the quarter as investors priced in the likelihood of an interest rate cut by the Fed. The yield on the 10-year US Treasury ended the quarter at a paltry 2.01%, down from 2.41% at the end of March, its lowest level since the immediate aftermath of the 2016 election.

A Record Expansion

Continued growth in the domestic economy accompanied the market’s advance. Indeed, the current expansion is now on the precipice of being confirmed as the longest in US history, eclipsing that of the 1990s. GDP expanded at an annual rate of 3.1% in the first quarter with all the primary elements of the economy contributing: consumer spending remains strong; business investment continues to grow incrementally; and government purchases once again set new records. The so-called “soft” data is a bit less rosy. Surveys of consumer and business confidence, new orders for manufactured goods, and analysts’ expectations for corporate profits all point to continued, though more subdued, economic growth.

Labor market conditions remain robust. According to the Bureau of Labor Statistics, private payrolls rose strongly during the quarter and the headline unemployment rate remains firmly under 4%, near a 50-year low. Boding well for consumer spending, hourly wages have continued their modest but persistent advance, rising at a rate above 3 percent as they have for much of the past year. All told, the data shows an economy that is still growing, albeit with the prospect that the pace will slow in the months ahead.

Global Risks

The US economy has shown impressive stamina during the last ten years. Of course, despite the evident underlying strength, risks remain. The primary culprits are, we believe, global in nature. Renewed tensions in the Middle East, most prominently the Saudi-led war in Yemen and the troubling deterioration in US-Iran relations, have the potential to impede global growth via a disruption in oil supplies. In the UK, there is still no pathway to Brexit. Matters there have been further complicated by the need to replace Theresa May as prime minister. While the initial push for Brexit largely originated from immigration-related politics and a widespread sense of frustration with European Union governance, the economic ramifications are profound. Over 40% of UK GDP is comprised of global trade – including over 20% with the European Union alone – highlighting the potential for local economic disaster should the parties fail to agree to a carefully planned process for Brexit ahead of the October deadline.

US-centric developments also bear watching. In late May, President Trump threatened to impose escalating tariffs on all goods coming from Mexico if their government didn’t stem the flow of migrants. Coming on the heels of a trade accord with both Mexico and Canada, the threat caught investors off guard. Hefty blanket tariffs could endanger the obvious economic synergies between the US and Mexico. Our southern neighbor is not only our second largest trading partner, but party to highly developed supply chains with components and finished goods (e.g. autos, electronics, and appliances) shuffling back and forth across the border throughout production. Thankfully, the President backed off from the prospective tariffs only weeks later, helping to fuel the market’s June resurgence.

Threats to levy new tariffs on other imports, including those from the EU, Canada, and India, have also been in the headlines in recent months, sometimes causing market gyrations. The stock market’s seesaw performance during the quarter, however, can be most closely linked to the ebb and flow of US-China trade talks. Stretching back to previous quarters, the market has rallied when a deal has appeared on the horizon only to fall (as it did in May) when prospects for a deal dimmed. Optimism was renewed in June as the Trump Administration put $300 billion of prospective tariffs on indefinite hold and the counterparties looked to restart negotiations at the G20 conference. Importantly, this round of talks does not include a self-imposed deadline. With the 2020 election looming, the current truce could be longstanding; status quo is often a positive in the eyes of economists and investors.

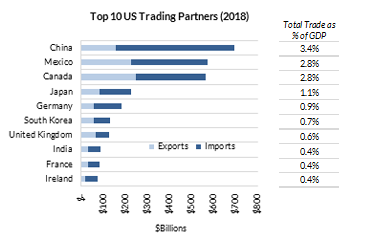

“Free trade” has been part and parcel of the rising global economic tide of the past forty years and has contributed greatly to the fortunes of US investors. Leveraging the free flow of capital, labor, and supply chains is a core competency of successful multinational corporations (including many holdings across our investment strategies). That said, the engine of the US economy remains predominantly domestic. As the chart below shows, total trade with China accounts for only 3.4% of US economic output, while trade with all our global partners combined accounted for only one fifth of the $20.5 trillion US GDP in 2018.

Market observers are right to monitor bilateral trade skirmishes and other impediments to global business, but it is also appropriate to view those disruptions in the context of the broader US economy. Absent a full-scale trade war, the US economy is likely to continue its current growth path.

The Fed’s Not-So-Invisible Hand

The renowned 18th century economist, Adam Smith, wrote of a free-market system that became the basis of American capitalism. He supported government intervention in some instances (e.g. infrastructure, military, etc.), but argued that the forces of private interest would provide prosperity and promote the public good. This was in direct contrast to the common economic policy of the day, mercantilism, marked by protectionism and government policies that sought to maximize exports.

With the government visibly intervening in global trading relationships, some of those protectionist policies appear to be back in vogue. Fortunately, another government body, the US Fed, has determined it should provide a countervailing force to the challenges now being posed to global trade to sustain the economic expansion. The Fed governors have clearly concluded that the normal risk of cutting rates amid a period of acceptable growth and low unemployment does not apply when inflation remains near the Fed’s own two percent target. Current surveys reflect an expectation of a rate cut at the Fed’s late July meeting, and both the stock and bond markets have priced that in accordingly. These expectations have placed investors in the ironic situation where moderately negative economic news is good for the market because it increases the likelihood of Fed stimulus.

Summary

Our view remains that the US economy is on sound footing and that a recession is not imminent. Risks associated with global matters, however, have been rising. Nonetheless, Fed policy initiatives and the unique advantages of the US economy should limit the challenges posed by continued uncertainty regarding trade. Meanwhile, equity valuations do not appear unreasonable considering the moderate pace of economic growth, healthy levels of corporate earnings and cash flows, and already-low interest rates. We thus continue to favor equities over low-yielding fixed income alternatives within the context of individual client guidelines. As always, we remain steadfast in our approach to invest in financially strong companies with sustainable business models.

Data Sources: Bloomberg, FactSet.

The information presented should not be considered as an offer, investment advice, or a recommendation to buy or sell any particular security. The information presented has been prepared from sources and data we believe to be reliable, but we make no guarantee to its adequacy, accuracy, timeliness or completeness. Opinions expressed herein are subject to change without notice or obligation to update.

About Boston Trust Walden Company

We are an independent, employee-owned firm providing investment management services to institutional investors and private wealth clients.