Q3 2019 Commentary

by Boston Trust Walden

October 10, 2019

Financial Markets

Stocks, as measured by the S&P 500, gained another percentage point during the third quarter, bringing the year-to-date return above 20%. Over the trailing 12 months the gains are a far more modest 4.3%. Given the persistent media emphasis on the market’s daily gyrations one could be forgiven for forgetting the sharp pullback at the end of 2018, but the market’s wide swings are indicative of the conflicting influences on investors. Most international stock indices were down for the quarter. With perceived risks rising, it is unsurprising that US large cap stocks, and particularly those with sustainable business models and more stable financial underpinnings, have led the market’s advance during the past year.

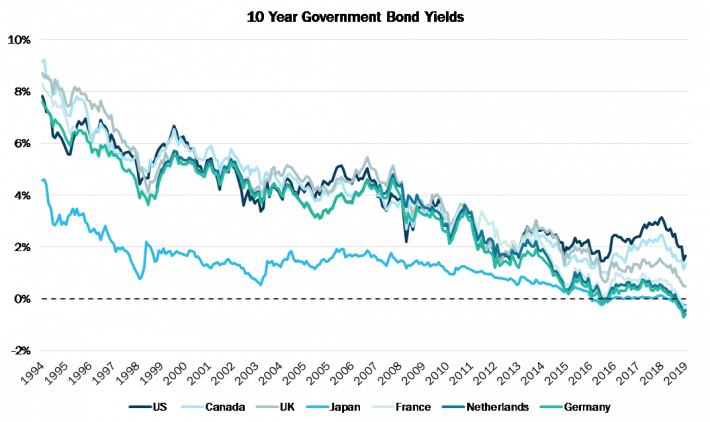

Bonds also gained as fixed income investors priced in continued low inflation and a heightened concern that the economy may slip into recession in the year ahead. The yield on the 10-year Treasury, which started the quarter at 1.99% fell to 1.45%, in early September before rising to 1.67% at quarter’s end. A similar decline in sovereign bond yields occurred throughout the developed world. At $54/barrel, crude oil prices were 7% lower for the quarter, despite jumping to $63/barrel mid-September after the bombing of two major Saudi oil facilities. Though oil markets settled, the spike was a reminder of the potential ramifications should tensions in the Middle East continue to worsen.

US Resilience & Fed Support

GDP grew by an annualized rate of 2% in the second quarter. Modest growth is also expected to be reported for the third quarter. The latest economic data has largely been bifurcated between business and consumer trends. Factory activity, as well as business investment and spending, has been sluggish in recent periods and forward-looking business sentiment has weakened. Indeed, recent sentiment readings are among the lowest reported since the financial crisis. Uncertainty stemming from the still unresolved trade disputes, particularly with respect to the potential disruption to established supply chains, is weighing on businesses’ decisions to invest in both foreign and domestic operations. In contrast, American consumer spending, which accounts for over two-thirds of GDP, remains strong. Consumers are amply supported by record low unemployment rates, steady wage growth, and access to abundant credit.

Because inflation remains modest, the Fed has the flexibility to provide a countervailing force to the uncertainty weighing on business spending. In both its July and September meetings, the Fed cut its benchmark interest rate by a quarter percentage point. These were the first such cuts since 2008; market expectations point to at least one, if not two, more quarter-point cuts this year. Further supporting its goal of improving economic conditions, the Fed has paused efforts to shrink the enormous bond holdings it acquired in the aftermath of the financial crisis. While the Fed has few tools to directly address the impact of geopolitics on trade, we consider it likely that the lower rate environment it has initiated will nonetheless help sustain the long domestic economic expansion. Low financing costs also continue to buttress corporate profit margins and support ample levels of free cash flow. Importantly, in contrast to some past periods, when accelerating inflation, rising short-term interest rates and an inverted yield curve were precursors of recession, current Fed policy is designed to lower the cost of doing business.

The Fed has the flexibility to provide a countervailing force to the uncertainty weighing on business spending.

Weakening International Economies Spur More Easing

While the US economy appears likely to remain on its slow growth, low inflation path, prospects for other developed economies are less favorable. Despite the continued efforts of its central bank, Japan shows no sign of breaking its decades-long streak of lackluster growth. Australia’s Reserve Bank cut its official cash rate for the third time in five months to buoy flagging economic indicators. The United Kingdom economy is increasingly being stymied by the political wrangling and uncertainty related to Brexit. And larger European Union economies, while healthily expanding only a year ago, are struggling to maintain their growth profiles. Specifically, Italy’s economy has stagnated under the weight of structural and political issues, while headwinds to global trade may push the manufacturing and export-dependent German economy into recession.

Despite the leadership transition taking place in November (when Mario Draghi will be succeeded by Christine Lagarde), the European Central Bank (ECB) took unexpectedly aggressive action in mid-September to head off the weakening environment. With unanimous support from its governing council, Mr. Draghi implored eurozone governments to provide more fiscal support for their economies with either tax cuts or debt-financed projects. For its part, the central bank committed to waiting for inflation to begin approaching its 2% target before raising rates, restarted purchases of government and corporate bonds (which it had suspended less than a year ago), and cut its benchmark interest rate on short-term deposits by 0.1% to a negative 0.5%.

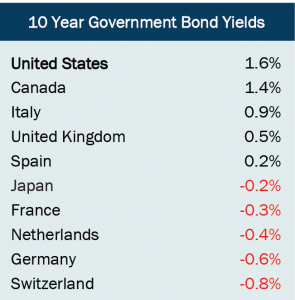

Negative Rates Abound

The ECB is not alone in instituting negative interest rates on cash reserves. Central banks in Japan, Switzerland, Sweden, and Denmark have also breached 0% in efforts to support their economies. To clarify, rather than paying interest on deposits held at the central bank, as is the current practice of the US Federal Reserve, these central banks are now charging banks for their excess cash deposits. The rationale is that a penalty for hoarding cash will further incentivize banks to offer loans to businesses and consumers, and in turn, stimulate the economy. The efforts have yet to bear significant fruit. Though we don’t know what the economic picture would be had central banks acted differently, it is concerning that the environment of low global rates may have deeply eroded the ability of monetary policy to stimulate economic growth.

Meanwhile, investors have been pushing down global interest rates for decades – a trend that has only deepened since the financial crisis. The chart below shows the trend of 10-year government bond yields of a handful of developed economies. Even some of these longer-term bonds have finally fallen through the 0% floor.

The prevalence of negative yielding debt is truly extraordinary. Of roughly $56.1T in outstanding global investment grade debt, over a quarter ($14.8T) now yields less than zero. Even long-term savers are effectively paying to lend their money. This phenomenon was nearly unheard of before 2014, the year in which the ECB set its policy rate below zero. With multiple central banks now having followed suit and negative yielding debt so common, a common question from clients has been: is the US next? Not necessarily. For one, it’s not clear if the Fed has the legal authority to set the Fed Funds rate below zero. Further, negative rates in the US could be destabilizing for money market mutual funds, a vital cog in the daily functioning of our capital markets (a difference from international markets). But more visibly, the US simply has more monetary and fiscal options at its disposal.

Years of steady, if slow, economic growth (with commensurate rate hikes and shrinking Fed balance sheet) has enabled the Fed to reload some of its tools, while the US Dollar’s standing as the world’s reserve currency affords unique advantages. As such, US long-term rates remain materially higher than global counterparts. This allows investors to achieve a modest, but positive return when holding bonds as a measure of protection in mixed asset portfolios. Significantly, the global rate picture does put a governor on US rates moving up sharply anytime soon. Other headwinds notwithstanding, persistent low rates are positive for US borrowers and aid prospects for continued economic growth.

Summary

Though business investment has been sluggish, a strong employment picture and robust consumer activity leaves the US economy on sound footing. The Fed has acted to keep the expansion going, while the global rate picture provides some assurance that longer-term interest rates will remain low for some time, too. Such low financing costs have aided corporations in maintaining high profit margins and cash flows, even as they face the continued uncertainty stemming from the trade war. Equity valuations do not appear unreasonable given this backdrop. Thus, within the context of individual client guidelines, we continue to favor stocks over low-yielding bond alternatives. As always, we remain committed to our approach of investing in companies with sustainable business models and strong financial underpinnings.

Data Sources: Bloomberg, FactSet

The information presented should not be considered as an offer, investment advice, or a recommendation to buy or sell any particular security. The information presented has been prepared from sources and data we believe to be reliable, but we make no guarantee to its adequacy, accuracy, timeliness or completeness. Opinions expressed herein are subject to change without notice or obligation to update.

About Boston Trust Walden Company

We are an independent, employee-owned firm providing investment management services to institutional investors and private wealth clients.