Q4 2019 Commentary

by Boston Trust Walden

January 14, 2020

Financial Markets

2019 was an extraordinary year for financial markets as equity indices around the globe recorded double digits gains. Once again, U.S. stocks were global leaders as the broad-based S&P 500 Index returned 31.5%. This was the best result for the Index since 2013 and among the five largest advances in three decades. Even assets usually considered safe havens with modest return expectations registered substantial gains: gold prices rose by 18% and the Bloomberg Barclays Aggregate Bond Index returned 8.7%. The rally in bonds pushed the yield on the 10-year US Treasury down by three quarters of a percent – ending the year at 1.92%. All told, 2019 represented the best simultaneous year for US stocks and bonds since 1998.

Investment Perspectives

Drivers of Return

The year’s strong equity market rise came on the heels of a steep drop during 2018’s fourth quarter. As usual, it is hard to pinpoint a single cause for the market’s quick rebound and subsequent ascent to new highs. However, the Fed’s unusual policy reversal in early 2019, dropping its plan to tighten monetary conditions and instead choosing to lower short-term interest rates, was the most obvious proximate cause. Other key factors sustaining the advance were the continued strong labor market which helped boost consumer spending and the apparent easing of a multiple-front trade war that has inflicted fewer economic casualties than anticipated. We can definitively note, though, that it was not corporate profit growth. Aggregate earnings for the S&P 500 grew modestly in 2019 (expected to amount to only 4% when the final reports are released in the coming months) – a far cry from the market’s 31.5% gain.

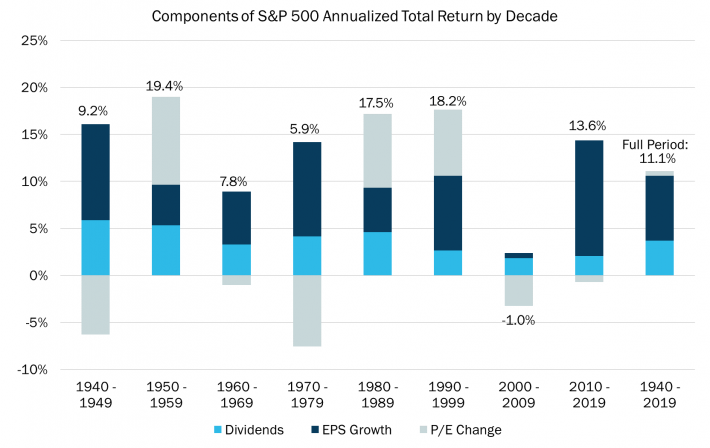

With dividends contributing roughly 2 percentage points alongside modest earnings growth, the lion’s share of the market’s 2019 return came from a change in valuation – the price investors were willing to pay for a unit of corporate profits. The price-to-earnings (P/E) ratio for the market stood at 20.4x at year-end — almost 25% higher than at the year’s outset. But starting points matter. If you look back two calendar years, the market’s P/E is virtually unchanged. In fact, the metric is now roughly 5% lower than where it stood at year-end 2017. Corporate earnings, boosted by the December 2017 tax cut, grew by 27% over that two-year period – similar to the market’s 26% two-year total return.

The past decade offers a longer-term perspective. On the heels of the financial crisis, aggregate corporate earnings and the stock market both reached their low points in 2009. At the end of that year, the market traded at close to 20 times deeply depressed earnings. While the valuation multiple did not remain constant in the interim, it ended the 10-year period only slightly higher than where it began. That was not the case for corporate profits. S&P 500 earnings per share grew by 178% over the decade, just shy of the market’s 190% price increase. Including the roughly 2 percent dividend yield paid along the way, you arrive at the decade’s extraordinary 257% (13.6% annualized) total return. The decade’s result illustrates a point that is easily overlooked: short-term market moves are often dictated by valuation changes caused by changes in investor sentiment. Long-term returns are typically driven by corporate profit growth and dividends. The chart below illustrates how these three components have contributed to stock returns over time.

Economic Growth

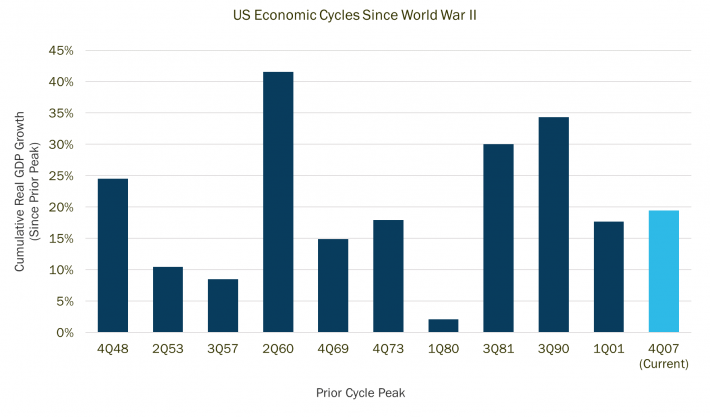

Long-term corporate profit growth is highly correlated to nominal GDP growth. As such, it is no wonder that the stock market’s performance is viewed as a reflection of investor expectations for the economy. But can the current expansion, now the longest on record, continue? We think so. To be clear, we don’t believe 2019’s market return signals that the pace of economic growth is about to accelerate. However, we do expect the US economy will remain on sound footing in 2020 and consider it likely that growth will continue at a solid, if unspectacular pace. Critically, despite the expansion’s unprecedented duration, the cumulative economic gain achieved during this cycle is unremarkable. This provides capacity for continued economic growth. Indeed, as the chart below shows, the magnitude of the current cycle is only on par with the average cumulative growth achieved during the ten previous cycles experienced since WWII.

In addition, we observe no obvious danger points in the domestic economy. In the aggregate, household balance sheets are strong and savings rates are near multi-year highs. The financial system remains on sound footing as banks have experienced only modest loan losses and have built plentiful reserves against future challenges. While corporations have taken advantage of low interest rates to increase borrowings, robust cash flows provide ample resources to service new debt. For its part, the Fed has remained supportive of continued growth, cutting its overnight interest rate three times in 2019. When the “repo” market (upon which banks rely for short term funding) was briefly disrupted in September, the Fed quickly and effectively intervened, reassuring investors that its ability to control short term interest rates was undiminished. Meanwhile, the global economy shows signs of improvement. The Global Manufacturing Purchasing Managers Index, a key indicator of changes in business sentiment, moved into positive territory in November.

Of course, challenges remain. The headline unemployment rate remains at a 50-year low and wages are rising. This good news for workers has a financial market downside. Absent an increase in the participation rate, full employment and rising wages could slow economic growth, spur inflation and squeeze corporate profit margins. Business investment spending has lagged, likely due to growth concerns abroad and uncertainty regarding US trading relationships. While this has allowed for rising dividends and share buybacks, the long-term effect may be declining productivity and slower growth. None of these concerns appear likely to derail the economy in 2020, but they and other challenges need to be monitored.

A Note on Global Trade

As has been the case for the last three years, global trade concerns garnered their fair share of headlines in the fourth quarter of 2019. Unlike most recent periods, however, many of the new developments served to decrease uncertainty. After lengthy negotiations between the White House and Democratic leaders, the House passed a new trade deal: the US-Mexico-Canada Agreement (“USMCA”). Changes from the previous agreement (NAFTA) include more worker wage protections, increased North American sourcing for auto components, and expanded intellectual property and digital commerce provisions. None of the new terms are likely to result in large changes to actual trade flows. However, the USMCA’s passage through the House (and expected passing in the Senate), removes the possibility of significant disruption to supply chains should NAFTA have been revoked without a new agreement in place. Similarly, uncertainty generated by the 2016 UK vote to exit the European Union has finally subsided. While Brexit is a move backward in the long trend toward global economic integration, markets are understandably relieved that the three-year political stalemate in Britain has finally – it appears – been resolved. (How Brexit will be implemented remains far from clear.)

Most significantly, China and the US are due to sign a “Phase One” trade deal in mid-January. At its core, the agreement serves as a truce to the trade war that has been waged via escalating tariffs. The terms include reducing some tariffs already in effect while eliminating those set to be enacted. China has also agreed to increase imports of US goods and services by $200B (over 2017 levels) over the next two years. The agreement is said to include stronger intellectual property and technology protections, though details have yet to be announced. Of course, like any deal, this one requires both sides to abide by its terms. Regardless, the agreement represents a de-escalation of the trade war – a positive for the Chinese and US economies, alike.

Outlook

Absent an unanticipated deterioration in the economic climate or renewed controversies regarding global trade, our outlook for corporate earnings remains positive. Meanwhile, market valuations remain at reasonable levels if viewed within the context of low inflation and interest rates and robust corporate free cash flows. Accordingly, within the framework of individual client guidelines, we continue to favor stocks over fixed income alternatives. But investors should be forewarned; as we have described in this memo, short-term market moves are largely dictated by changes in investor sentiment, not earnings. And 2020, a presidential election year with an impeachment trial in prospect, is likely to be filled with wide swings in sentiment. If recent headlines are any guide, geopolitical risks are also mounting. Thus, we anticipate heightened market volatility. While it is our discipline to avoid adjusting our investment strategy in response to every market turn, we believe that our long-held emphasis on financially strong companies, reasonable valuations, and prudent diversification will allow portfolios to earn attractive returns in a range of market outcomes.

Past performance is not indicative of future results.

Data Sources: Bloomberg, FactSet, Standard & Poor’s, NBER, Federal Reserve Bank of St. Louis

The information presented should not be considered as an offer, investment advice, or a recommendation to buy or sell any particular security. The information presented has been prepared from sources and data we believe to be reliable, but we make no guarantee to its adequacy, accuracy, timeliness or completeness. Opinions expressed herein are subject to change without notice or obligation to update.

About Boston Trust Walden Company

We are an independent, employee-owned firm providing investment management services to institutional investors and private wealth clients.