Q2 2022 Investment Commentary

by Boston Trust Walden

July 12, 2022

Financial Markets

Stocks, like most financial assets, sold off sharply during the second quarter, with the S&P 500 Index losing 16.1%. The Index also officially entered bear market territory after falling more than 20% from its early January highs. Rising interest rates impacted performance among stocks. So-called “growth” stocks, whose inherent value lies more in their future profits and growth thereof, are especially sensitive to interest rate changes and were disproportionately punished relative to “value” stocks. Yet, virtually all stocks – regardless of underlying business attributes – moved lower as investor sentiment waned in response to the increasing likelihood of recession. Though the downturn is significant, it’s worth noting the Index closed the quarter at levels reached only in March of last year.

Bonds hardly offered any respite. The 10-year US Treasury bond had a total return of -5.2% for the quarter as its yield rose from 2.34% to 3.02%, while corporate bonds fared worse as credit spreads widened with increasing economic risks. All told, the Bloomberg Government/Credit Bond Index lost 5.0% during the period, bringing year-to-date losses into double digits.

Overseas markets have participated in the decline as well; MSCI’s Developed (ex US) and Emerging Market Indices were down 14.7% and 11.5%, respectively, in the second quarter. Many commodities were also down for the period, though oil rose due to continued supply issues related to the Russia/Ukraine conflict. And for good measure, the world’s largest cryptocurrency, Bitcoin, lost almost 60% of its value by the end of the quarter.

Investment Perspectives

The second quarter showcased how quickly economic and market conditions can change, as well as investor confidence. The market’s volatility in the beginning of the year largely reflected uncertainty about specific issues, including appropriate valuation levels, the escalating conflict in Ukraine, and lockdowns in China. But that uncertainty has increasingly transitioned to pessimism regarding global economic prospects. Though there are myriad reasons for this, none weigh as heavily as inflation, and the Fed’s plan to fight it.

An Inflation-Fighting Fed

The Federal Reserve (Fed) has repeatedly voiced its commitment to easing inflationary pressures. Though Fed Chairman Powell noted an intention of doing so while maintaining a positive growth trajectory, it is evident that ensuring price stability (i.e., controlling inflation) is the monetary body’s current priority. As society attempts to return to normalcy after a string of highly unique periods relating to the pandemic, the Fed has acknowledged what we have observed in our own day-to-day lives: conditions continue to be highly dynamic. Accordingly, the Fed has committed to being data-dependent, rather than following a predetermined path for its policies. Comments and actions during the quarter show an adherence to such a strategy. In early May, Powell noted that “a 75 basis point increase is not something the Committee is actively considering.” However, subsequent economic data dictated otherwise, and only a matter of weeks later the Fed signaled renewed urgency by raising its benchmark overnight rate by the aforementioned 0.75%. Not only was this the first increase of such size since 1994, but the Fed did not rule out a subsequent increase of the same magnitude.

The Fed’s forcefulness is showing its teeth – at least as it relates to borrowing costs. Though the central bank only formally controls the overnight rate at which it lends to banks, its newfound aggressiveness has become embedded in economic and market expectations, and therefor has affected a broad array of interest rates. The rate at which the federal government can borrow, as indicated by US Treasury bond yields, has risen for both short- and long-term borrowing. The financing rates afforded to corporations — whose costs not only include the “risk free rate” assigned to the government, but an additional premium or “spread” for a company’s inherent riskiness – have risen more significantly. The yield for the US Investment Grade Corporate Bond Index ended the quarter at 4.70% – up from 3.60% at the beginning of the period and 2.33% at the beginning of the year. The likely, and desired, impact of these rising rates is a slowdown in the pace of business investment – whether it be building new facilities or hiring additional staff – and in turn, a slowdown in economic growth and reduction in inflationary pressure.

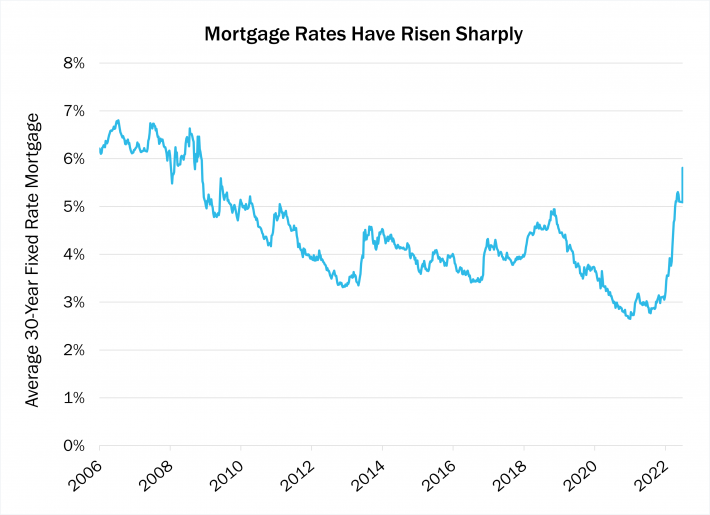

Like government and businesses, consumers are also seeing higher borrowing costs. Housing-related debt is the largest component of aggregate household borrowings, and mortgage rates react swiftly to changing market conditions. Indeed, the average rate on a 30-year fixed mortgage began the year at 3.11% but has rocketed upwards to 5.70%. Such rates are the highest they’ve been since 2008 and have begun to cool the previously red-hot housing market. Economic activity associated with homebuilding and home purchases helps fuel the economy. Less housing activity can reduce pricing pressures related to both building materials and labor, playing to the Fed’s intentions. Other consumer financing rates, like those on credit cards and auto loans, are beginning to creep higher as well, which will also serve to crimp aggregate consumer demand.

Source: Freddie Mac

Will Inflation Moderate?

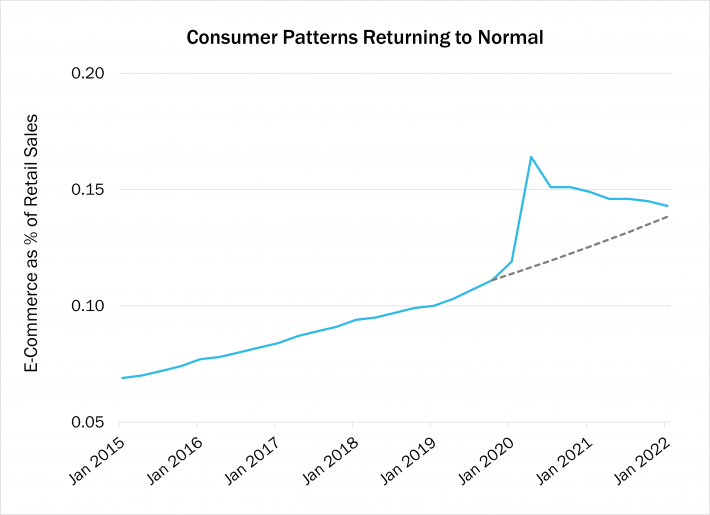

The Fed expects slowing economic growth will curb inflation. As evidenced by downgrades to its economic projections, it believes its actions are at least having the desired impact on the expansion. Concurrent with the Fed’s efforts, inflation readings are likely to benefit from receding pandemic-related influences, too. Normalizing consumer spending patterns (i.e., returning to services over goods, as we covered in our first quarter commentary) reinforce our expectation that supply chain issues – a contributor to inflationary pressure – will continue to resolve. Another example of such normalization is where consumers are shopping: the meteoric rise in the share of online retail sales has not only waned since the peak of the pandemic, but it has effectively fallen back to its pre-pandemic trendline.

Source: Federal Reserve Bank of St. Louis

Despite elements of moderation, the risk of sustained inflation remains. Labor markets have already seen wages rise faster than they have in decades, and it’s possible this becomes self-perpetuating. Indeed, the most significant risk may be psychological. As inflation readings remain high, so do expectations for more of the same; the latest survey from the NY Fed noted that consumers expect inflation to be 6.6% in the coming year, up from 6.3% in the prior month’s survey. The longer-term risk is that such expectations become entrenched, setting off cycles of anticipatory price hikes, wage increases, etc.

Outlook and Positioning

We view the Fed as committed to tamping down inflation, and there is an increasing probability that its course of action may indeed induce a recession. While such periods are not pleasant, they are also not unusual, and we accept them as part of the economic cycle. The market’s selloff is reflective of investors’ collective expectation of such a forthcoming recession. However, as we consider our outlook, it is key to appreciate that financial markets are forward looking. In other words, current stock prices and valuations already reflect expectations for further monetary tightening, weakening economic demand, and potentially lower corporate profits.

Stock valuations can be readily viewed as a measure of investor sentiment. With a rosy outlook for economic and corporate profit growth, stocks generally trade at premium valuations. Conversely, as economic prospects dim, stock valuations typically do the same and often fall below their long-term averages. It is largely this valuation ebb and flow that dictates stock performance in the short term, while longer-term returns are driven by the path of corporate profits.

Though near-term economic concerns have depressed sentiment, and in turn stock prices, the longer-term profit potential of many corporations has not been impaired. This is especially true for the companies with sustainable business models in which we seek to invest. In many cases, such stocks have moved from trading at a premium valuation relative to their historical averages to a discount. Consequently, we now expect higher long-term returns for such issues than we did only a few months ago; their performance will reflect underlying growth in profits as well as an expected increase in valuation back to historical averages. And by the nature of corporate profits being reported in nominal terms (i.e., including the impacts of rising prices), they may provide a natural hedge against inflation should it persist longer than anticipated. Dominant companies with the pricing power to maintain profit margins provide further protection. As such – and in the context of client specific considerations, including near-term liquidity needs – we continue to favor stocks of high quality companies in multi-asset portfolios.

Bonds retain an important role in multi-asset portfolios as well. It is worth acknowledging that long-term expected returns for fixed income instruments have become more appreciable as yields have risen. Moreover, Treasury bonds remain one of the best assets to hold in the event of an unanticipated shock to the economy. Among the most salient of such risks are those related to geopolitical tensions, a resurgence in Covid due to further virus mutation, or an unexpectedly deep recession. Within corporate bond holdings, we continue to focus on companies with strong businesses and balance sheets that can weather an economic downturn, should one materialize.

Boston Trust Walden Company is a Massachusetts-chartered bank and trust company. Past performance is not indicative of future results. Data Sources: Bloomberg, FactSet. The information presented should not be considered as an offer, investment advice, or a recommendation to buy or sell any particular security. The information presented has been prepared from sources and data we believe to be reliable, but we make no guarantee to its adequacy, accuracy, timeliness, or completeness. Opinions expressed herein are subject to change without notice or obligation to update.

About Boston Trust Walden Company

We are an independent, employee-owned firm providing investment management services to institutional investors and private wealth clients.