Q4 2020 Commentary

by Boston Trust Walden

January 13, 2021

Financial Markets

Already well past recovering the losses from earlier in the year, the stock market rallied sharply during the final three months of 2020. Stocks, as measured by the S&P 500 Index, gained 12.15% in the fourth quarter, bringing the Index’s full-year return to 18.40%. The change in tenor of the market’s gains during these last few months was striking, too. Though the early stage of the stock market’s surge was led by larger, growth-oriented technology-related firms (as we covered in our 2nd Quarter 2020 commentary), the gains in the fourth quarter were more broad-based. A case in point was the small capitalization Russell 2000® Index which led domestic stock indices during the quarter with a return of 31.37%. The gain allowed the Index to approximate the returns of the primary large cap indices for the full year. Beyond size, investors also looked to segments that had been out of favor for much of the year. These included the more economically sensitive, but slower growth financial and industrial sectors, international stocks, and most commodity businesses. Diversified bond indices, after strong gains earlier in the year, rose only slightly during the quarter. The exceptions were inflation-linked bonds and lower quality corporates – both of which rallied on renewed economic optimism.

These sizeable gains were almost entirely achieved in the latter two months of the quarter. In that time, positive vaccine developments, continued central bank support, signs of new fiscal relief, and a clear outcome of the presidential election provided key counterpoints to the uncertainty that had clouded outlooks earlier in the year. This clarity provided investors with the confidence to bid up asset prices across the spectrum.

Investment Perspectives

While the market’s gains were welcome, they stand in contrast to the continued economic distress stemming from the pandemic. As we covered in our 3rd Quarter 2020 commentary, as well as on our blog, there are large disparities between the economy and stock market that account for much of their varying paths. Equally important, while economic reports only describe the recent past, investors look forward, valuing stocks based upon their expectations for the future. Indeed, the market is often viewed as an aggregation of investors’ beliefs about the path of corporate profits both in the near term and long into the future. Judging by the market’s fourth quarter rally, investors believe the long-term outlook has brightened. We agree.

Finally, Some Answers

The pandemic remains central to all forecasts. Though COVID-19 cases and death counts continue to rise, the developments related to vaccines during the last couple months likely had the greatest impact in setting the market’s positive tone. Better-than-expected trial data was released for two vaccine candidates, and shortly thereafter they received Emergency Use Authorization by the FDA. Other candidates have also reported promising preliminary data, with additional and broader approvals expected in the coming months. Even under the best of circumstances, however, the vaccination program entails huge logistical challenges. Amongst these are special storage and handling requirements, reconstitution protocols, booster shots at a specified lag, and the goal of medically optimal and socially equitable prioritization. Given these challenges, it is not surprising that the program has encountered a slower-than-hoped for start. We are encouraged by Dr. Fauci’s forecast that the program will quickly gain momentum. Regardless, there is now a light at the end of the long tunnel we have suffered in together during the past ten months.

The economic crisis has also received some notable shots in the arm. For its part, the Federal Reserve stayed the course in providing unprecedented relief through its bond purchases and interest rate policy. In an unusual departure from past protocol, Fed Chairman Powell has also repeatedly urged Congress and the administration to provide additional fiscal support and refrain from limiting the Fed’s discretion in exercising its policy options.

After many months of impasse, legislation was finally completed near year end. At $900 billion the new law is less than half the size of the $2.2 trillion CARES Act that was passed in late March, but it could be just as impactful, ensuring the continuation of the nascent economic recovery. Furthermore, the funding is mostly targeted at those persons who need it most and are thus most likely to spend it, providing further economic stimulus. Among the programs included are an extension of enhanced unemployment benefits, direct payments to individuals at the lower end of the income spectrum, and support for education, childcare, rent, and nutrition assistance. The law also provides a new cash infusion for the Paycheck Protection Program (PPP), including set-asides for very small businesses and community-based lenders. We view this relief as a vital lifeline to a sustained recovery. However, given the uncertain pace of vaccinations and continued mounting infections, we expect the new Congress and Administration will provide additional relief.

The November election provided another measure of clarity for market participants. Though a down-ballot “Blue Wave” of Democratic victories did not materialize, the Biden Administration will nonetheless take the helm on January 20th. The Democrats did retain control in the House, and by way of the early January run-off in Georgia and Vice President Harris’s tiebreaking vote, will have an effective majority in the Senate. While it is sometimes argued that investors would prefer divided government due to the likelihood that tax and regulatory policy would remain mostly unchanged, the Democrats’ razor thin majority will likely limit any bold initiatives in domestic economic policies. Perhaps more consequentially, unified Democratic control increases the likelihood of additional deficit spending. Further, the Executive branch has significant control over foreign policy. President Biden will have the opportunity to shape trade policy and the country’s stance on global cooperation generally. While specific policies are yet to be articulated, we expect fewer of the confrontational, tariff-based trade battles than we have seen over the last several years. In our view, returning to the decades-long trend of globalization that supported rising global wealth, albeit to varying degrees, is a positive for the economy and stocks alike.

Economic Outlook

Though the above developments provide some clarity about where we are headed, the near-term path forward remains murky. The positive news of vaccine approvals has been met by the cold water of distribution challenges. Meanwhile, welcome fiscal relief is counterbalanced by the sobering economic destruction we have witnessed during the pandemic. Businesses have closed, jobs have been lost, and rising food insecurity has strained food banks across the country. This economic pain has not been felt evenly across industries, nor the population. Much of the economic displacement has been felt by those on the lower rungs of the economic ladder, and particularly by those employed in hospitality-related service industries. Their hardship is showing up in some of the economic data. According to the Federal Housing Administration, which insures home loans to low-to-moderate income borrowers, over 10% of their single-family home loans were 90-days delinquent in November. A year prior, that figure was just 2%.

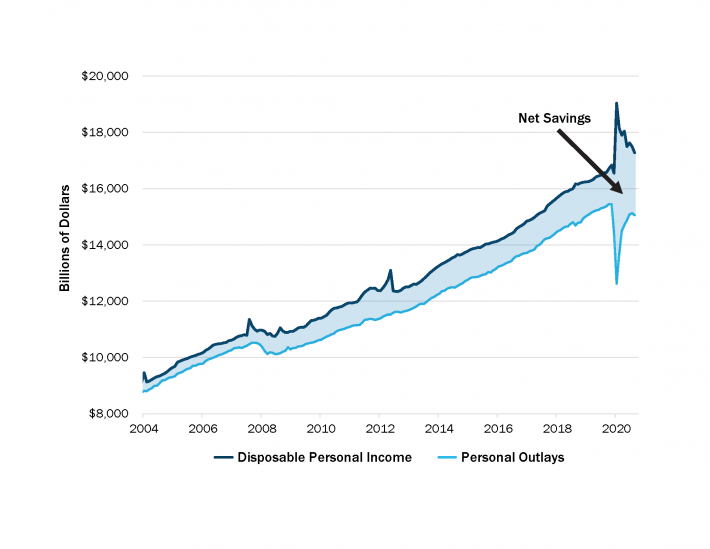

Ironically, in the aggregate, American balance sheets have actually improved during the past year. Largely due to the programs included in the CARES Act, cumulative personal after-tax income increased by 8% from March through November versus the same period in 2019. Even after many of the CARES programs expired, aggregate November income was above the pre-pandemic level. Concurrently, restrictions that have largely prevented travel, eating out, in-person shopping, and live entertainment among other activities, has sharply reduced household spending. The combination caused aggregate savings to spike. Americans saved over $1.5 trillion during the nine months ended November – almost three times that of the same year-earlier period.

Net Savings

Source: Bureau of Economic Analysis. Data as of 11/30/2020. Data reflect a seasonally-adjusted annualized rate.

Many of those with means have invested these newfound savings in financial assets, bidding up prices of everything from stocks and bonds to Bitcoin and baseball cards. Others have taken the opportunity to purchase new property, with home sales and prices surging. But plenty remains in cash and bank deposits, where balances have grown substantially since the beginning of March. As the vaccine is more broadly distributed and activity restrictions are lifted, it’s likely these savings will make their way back into the economy. Pent-up demand could spur rapid improvement in business and employment conditions for industries that have been disproportionately punished, thereby boosting and broadening the economic recovery.

Portfolio Positioning

After gaining 55% in value over the last two years, stocks are no longer cheap. But current prices, in our view, still allow for further appreciation. With continued support from the Fed and Congress, and a vast pool of pent up consumer demand, prospects for the economy appear bright. We anticipate that corporate profits will rise substantially in 2021. This includes continued momentum for those companies who either benefited from or were unaffected by the stay-at-home policies, and a rebound for the more economically sensitive companies that saw sharp declines in earnings in 2020. Accordingly, we favor stocks. We remain steadfast in identifying financially strong companies with sustainable business models and reasonable valuations. These stocks should participate in the above tailwinds, but also provide a measure of protection relative to those with riskier businesses and/or shares that imply an unsustainable level of future growth.

Alternatives to stocks have limited appeal. Courtesy of the Fed’s actions, yields on cash and money market funds are effectively zero. Longer dated bonds aren’t much better with the 10-year US Treasury yielding roughly 1%. (Indeed, so-called “real” bond yields – the amount earned after subtracting anticipated inflation – are negative!) But even at these levels, bonds still have a place in multi-asset portfolios. Even under the most optimistic forecasts, the path toward full economic recovery is unlikely to be smooth. Stock prices will be volatile, subject to changes in sentiment as well as economic conditions. In contrast, high quality bonds should provide some ballast to portfolios if equity market conditions worsen. As such, and in accordance with client-specific considerations, we continue to retain an allocation to bonds.

Boston Trust Walden Company is a Massachusetts-chartered bank and trust company.

Past performance is not indicative of future results.

Data Sources: Bloomberg, FactSet financial data and analytics, FTSE Russell, MSCI, Standard & Poor’s

The information presented should not be considered as an offer, investment advice, or a recommendation to buy or sell any particular security. The information presented has been prepared from sources and data we believe to be reliable, but we make no guarantee to its adequacy, accuracy, timeliness or completeness. Opinions expressed herein are subject to change without notice or obligation to update.

About Boston Trust Walden Company

We are an independent, employee-owned firm providing investment management services to institutional investors and private wealth clients.